How to Build Calm Money Habits Without Complex Budgets

A simple step-by-step guide to creating calm money habits that reduce stress, improve control, and help you manage finances without rigid budgeting.

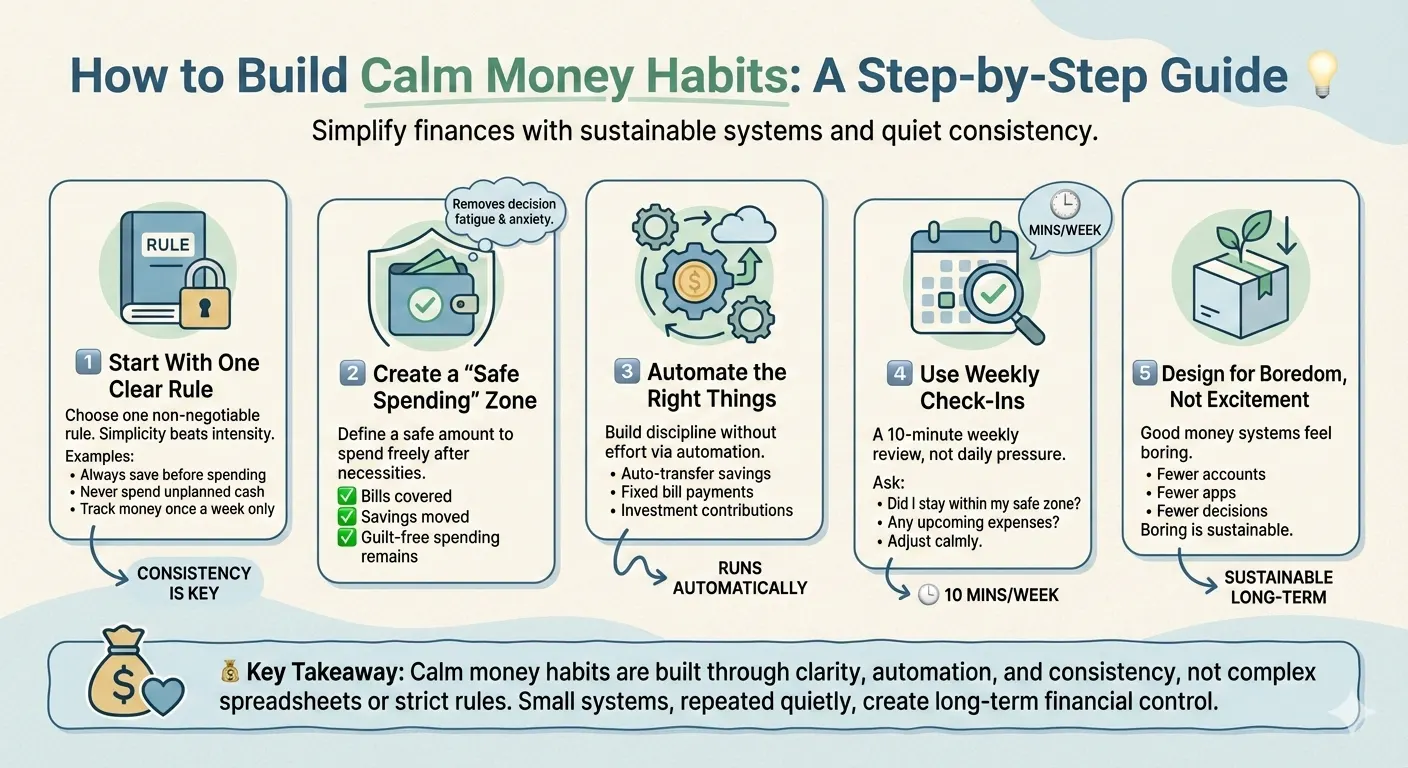

How to Build Calm Money Habits: A Step-by-Step Guide

Managing money doesn’t have to feel strict or stressful. This guide shows how to build calm, sustainable money habits that work quietly in the background 💡

1️⃣ Start With One Clear Rule

Choose one non-negotiable rule, not ten goals.

Examples:

-

Always save before spending

-

Never spend unplanned cash

-

Track money once a week only

Simplicity beats intensity. One rule done consistently wins.

2️⃣ Create a “Safe Spending” Zone

Instead of detailed budgets, define a safe amount you can spend freely.

✔️ Bills covered

✔️ Savings moved

✔️ Guilt-free spending remains

This removes decision fatigue and money anxiety 😌

3️⃣ Automate the Right Things

Automation builds discipline without effort:

-

Auto-transfer savings

-

Fixed bill payments

-

Investment contributions

What runs automatically doesn’t rely on motivation.

4️⃣ Use Weekly Check-Ins, Not Daily Tracking

Daily tracking creates pressure.

A 10-minute weekly review keeps awareness without stress.

Ask:

-

Did I stay within my safe zone?

-

Any upcoming expenses?

📌 Adjust calmly, not emotionally.

5️⃣ Design for Boredom, Not Excitement

Good money systems should feel boring.

-

Fewer accounts

-

Fewer apps

-

Fewer decisions

If it’s boring, it’s sustainable.

Key Takeaway

💰 Calm money habits are built through clarity, automation, and consistency, not complex spreadsheets or strict rules.

Small systems, repeated quietly, create long-term financial control.