How to Build Calm Money Habits That Actually Last

A step-by-step guide to calm money habits that reduce stress, improve control, and build lasting confidence.

Managing money doesn’t have to feel stressful or restrictive. This how-to guide shows you how to build calm, sustainable money habits that work quietly in the background of your life 💰

Step 1: Redefine What “Good Money Management” Means

Many people chase perfection. Calm money habits focus on consistency, not control.

Money works best when it supports your life, not when it dominates your thoughts.

Start with this mindset shift: progress matters more than precision.

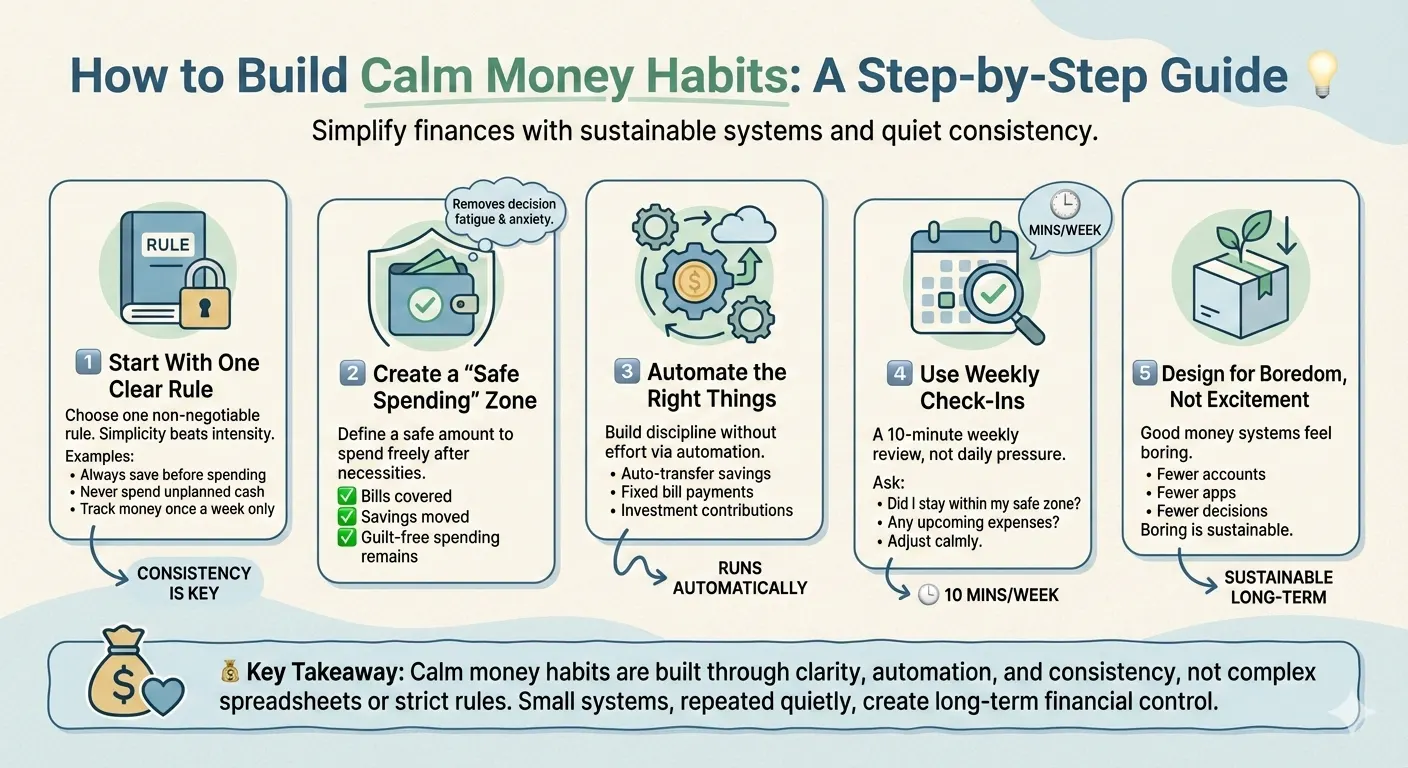

Step 2: Create One Simple Money Rule

Instead of many rules, choose one clear principle you can follow daily:

-

Spend less than you earn

-

Save before spending

-

Track only large expenses

One rule = less mental fatigue 🧠

Step 3: Automate What Causes Stress

Automation removes emotion from decisions:

-

Automatic savings transfers

-

Scheduled bill payments

-

Fixed investment contributions

If a habit is automated, it doesn’t rely on motivation.

Step 4: Use “Soft Tracking” Instead of Strict Budgets

Rather than tracking everything, review your money weekly:

-

Check total spending

-

Notice trends, not mistakes

-

Adjust gently

This keeps awareness high without guilt.

Step 5: Build a Financial Buffer First

Before big goals, focus on stability:

-

Small emergency fund

-

One month of predictable expenses

Security creates calm before growth 🛡️

Step 6: Schedule a Monthly Money Reset

Once a month, ask:

-

What worked?

-

What felt stressful?

-

What can be simpler next month?

Calm finances come from reflection, not restriction.

Step 7: Protect Your Energy

Avoid constant financial content and comparisons. Too much advice leads to confusion.

Clarity grows in quiet spaces ✨

Final Thought

Calm money habits aren’t about doing more. They’re about doing less, better, and consistently. When money feels predictable, confidence follows—and financial growth becomes a natural result.