Mastering Personal Finance Through Simple Daily Money Systems

A clear and practical guide that shows how to improve personal finances using simple daily money systems designed to reduce stress and boost savings

How to Build Daily Money Systems That Strengthen Your Personal Finances

Improving your finances doesn’t require complex strategies. What truly creates stability is building simple daily money systems that guide your decisions automatically. This tutorial shows how to set them up step-by-step.

1️⃣ Start With a Clear Snapshot of Your Finances

Before building any system, you need clarity.

List your:

-

Essential expenses

-

Optional expenses

-

Income sources

-

Savings goals

A clear financial snapshot gives you control instead of guesswork.

2️⃣ Use the “3-Account Method” for Easy Money Flow

Create three separate accounts to simplify management:

-

Bills Account for essentials

-

Spending Account for daily use

-

Savings Account for goals

💡 This structure prevents overspending by separating needs from wants.

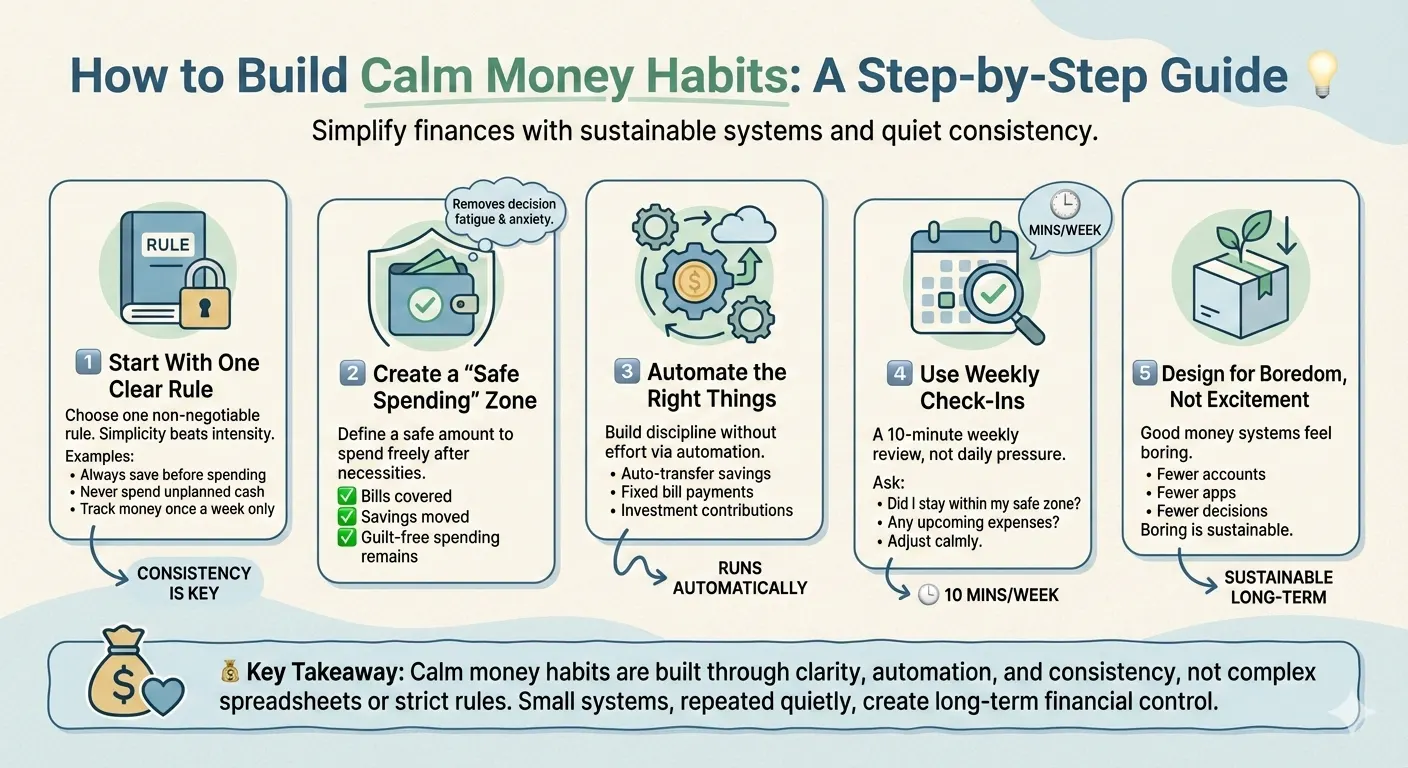

3️⃣ Automate Key Financial Actions

Automation removes the pressure of decision-making.

Automate:

-

Savings transfers

-

Bill payments

-

Debt payments

⚡ Small automated transfers grow quietly in the background.

4️⃣ Track Expenses With a Quick Daily Check-In

You don’t need long budgeting sessions.

Spend one minute checking:

-

Today’s spending

-

Remaining balance

-

Any unusual transactions

📊 Tiny daily check-ins build powerful financial awareness.

5️⃣ Create a Simple Rule for Impulse Purchases

Set a personal spending rule—for example:

-

Wait a short period before buying

-

Only buy if it fits your budget

-

Avoid purchases that disrupt your savings goal

🛑 This one rule can save you from constant emotional spending.

6️⃣ Make Savings a Non-Negotiable Habit

Treat savings like a bill.

-

Save a small fixed amount

-

Increase gradually

-

Celebrate progress, even if slow

💰 Consistency matters more than size.

7️⃣ Review and Adjust Your System Regularly

Your money system should evolve with your goals.

A flexible system ensures long-term success without feeling restrictive.

Final Takeaway

Strong personal finances are built through small, daily actions—not complicated strategies. When you put simple systems in place, your money becomes easier to manage, your stress decreases, and your goals feel closer than ever.