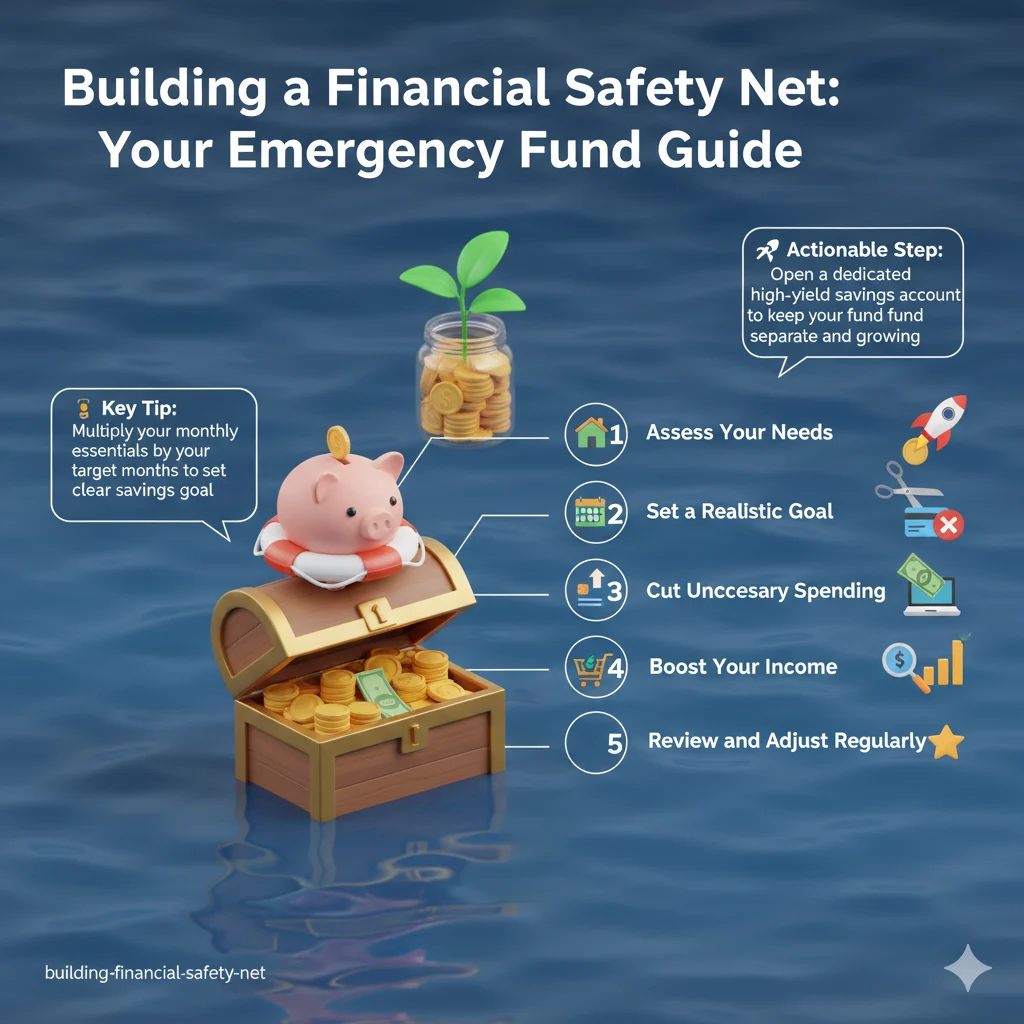

Step-by-Step Guide to Building an Emergency Fund

Discover how to build a robust emergency fund with this simple step-by-step guide, empowering you to handle unexpected expenses

Building an emergency fund is a key move for financial stability. This guide walks you through the process, making it straightforward and actionable.

Step 1: Assess Your Needs Start by evaluating your monthly expenses. Track essentials like housing, food, and transportation. Aim for a fund that covers three to six months of these costs.

💡 Key Tip: Multiply your monthly essentials by your target months to set a clear savings goal.

Step 2: Set a Realistic Goal Begin small if you're new to saving. Target an initial amount, like enough for one unexpected bill, then build from there. Use automated transfers to make saving effortless. 🚀 Actionable Step: Open a dedicated high-yield savings account to keep your fund separate and growing.

Step 3: Cut Unnecessary Spending Review your habits to find savings opportunities. Skip impulse buys and dine out less. Redirect those funds directly to your emergency stash.

🔑 Pro Insight: Track spending for one month to spot leaks—small changes add up fast.

Step 4: Boost Your Income Explore side gigs or freelance work to accelerate your progress. Sell unused items or negotiate a raise at your job. Every extra dollar counts toward security. 💰 Quick Win: Dedicate all windfalls, like bonuses or gifts, straight to your fund.

Step 5: Review and Adjust Regularly Check your fund's growth quarterly. Life changes? Update your goal accordingly. Celebrate milestones to stay motivated.

🌟 Essential Reminder: Treat this fund strictly for true emergencies—replenish it immediately after use.

Follow these steps consistently, and you'll gain confidence in facing financial surprises.