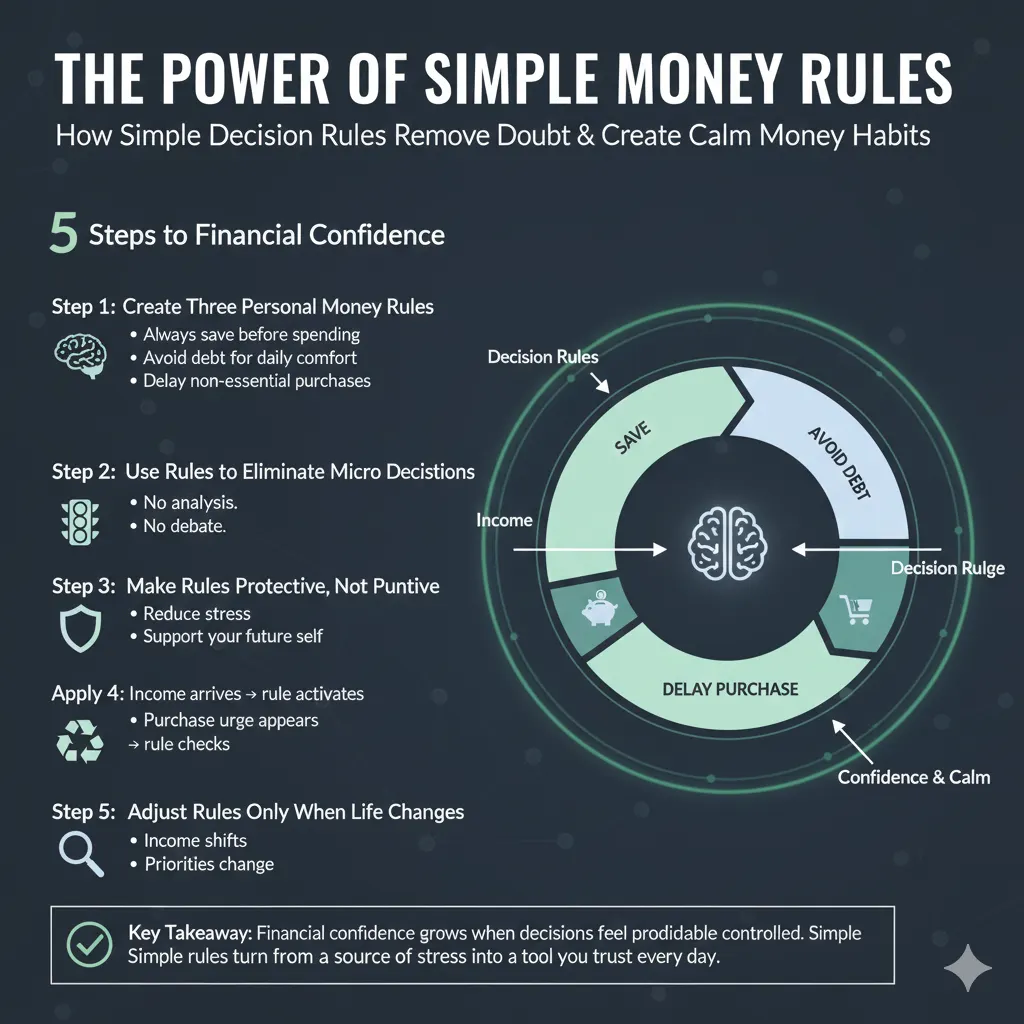

How to Build Financial Confidence Using Simple Decision Rules

A practical guide to building lasting financial confidence by using clear decision rules that reduce doubt, prevent mistakes, and simplify daily money choices.

Financial confidence doesn’t come from knowing everything—it comes from knowing how to decide. This how-to guide shows how simple decision rules can remove doubt and create calm money habits. 💰

Step 1: Create Three Personal Money Rules 🧠

Limit yourself to just three rules, such as:

-

Always save before spending

-

Avoid debt for daily comfort

-

Delay non-essential purchases

Few rules followed consistently beat many rules ignored.

Step 2: Use Rules to Eliminate Micro Decisions 🚦

When a situation appears, apply the rule.

No analysis. No debate.

This saves mental energy and reduces emotional spending.

Step 3: Make Rules Protective, Not Punitive 🛡️

Good rules should:

-

Reduce stress

-

Increase safety

-

Support your future self

If a rule creates anxiety, simplify it.

Step 4: Apply Rules Automatically 🔁

Attach rules to actions:

-

Income arrives → rule activates

-

Purchase urge appears → rule checks

Automation strengthens confidence faster than willpower.

Step 5: Adjust Rules Only When Life Changes 🔍

Do not tweak rules weekly.

Change them only when:

-

Income shifts

-

Responsibilities grow

-

Priorities change

Key Takeaway ✅

Financial confidence grows when decisions feel predictable and controlled. Simple rules turn money from a source of stress into a tool you trust every day.