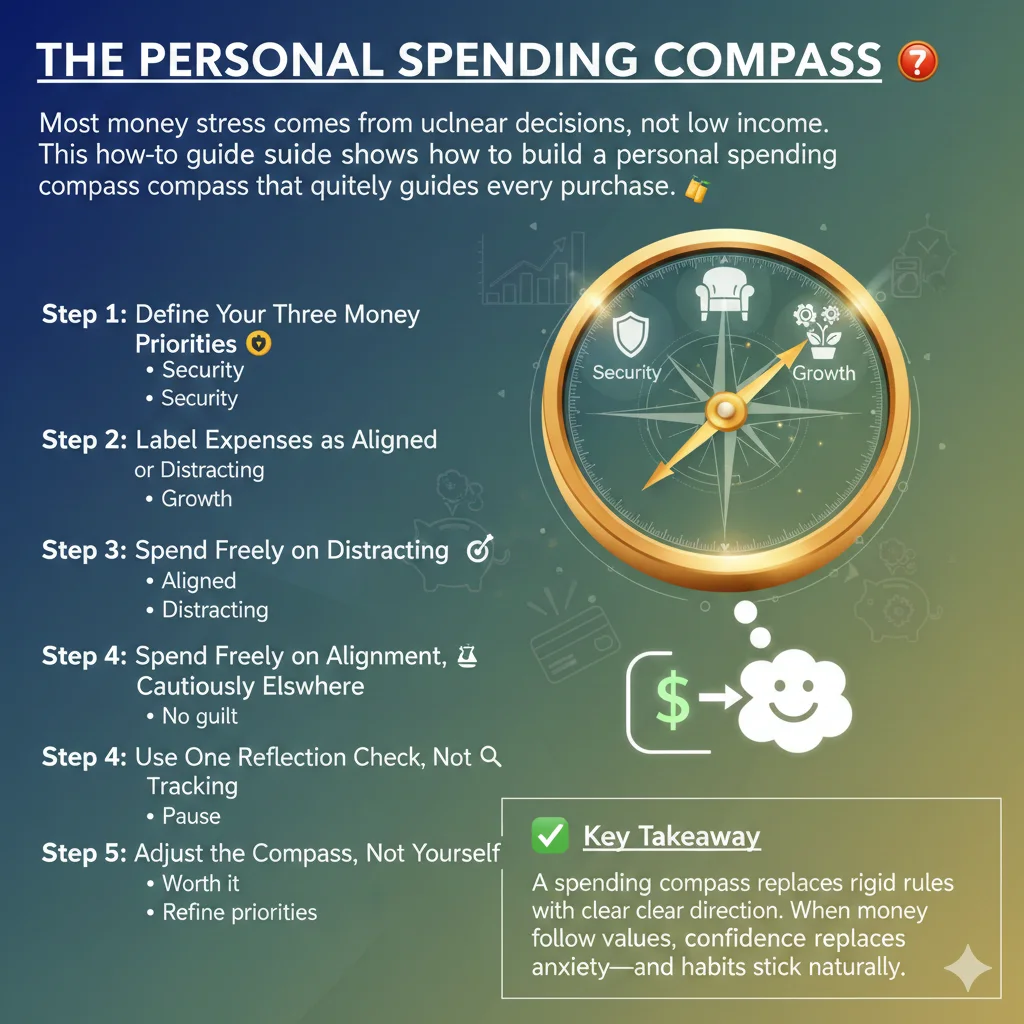

How to Create a Personal Spending Compass That Guides Decisions

A practical method to build a personal spending compass that helps you make confident money decisions without guilt, stress, or constant budgeting.

Most money stress comes from unclear decisions, not low income. This how-to guide shows how to build a personal spending compass that quietly guides every purchase. 💰

Step 1: Define Your Three Money Priorities 🧭

Choose only three areas that truly matter to you:

-

Security

-

Comfort

-

Growth

(or your own versions)

Money feels lighter when it follows clear priorities.

Step 2: Label Expenses as Aligned or Distracting 🎯

For each purchase, ask:

-

Does this support my priorities?

-

Or does it distract from them?

No judgment—just direction.

Step 3: Spend Freely on Alignment, Cautiously Elsewhere ⚖️

When spending aligns:

-

No guilt

-

No second guessing

When it doesn’t:

-

Pause

-

Reduce

-

Delay

Freedom grows when spending has meaning.

Step 4: Use One Reflection Check, Not Tracking 🔍

Once in a while, review:

-

What felt worth it?

-

What didn’t?

Awareness beats detailed tracking.

Step 5: Adjust the Compass, Not Yourself 🔄

If stress appears:

-

Refine priorities

-

Clarify values

Never assume discipline is the problem.

Key Takeaway ✅

A spending compass replaces rigid rules with clear direction. When money decisions follow values, confidence replaces anxiety—and habits stick naturally.