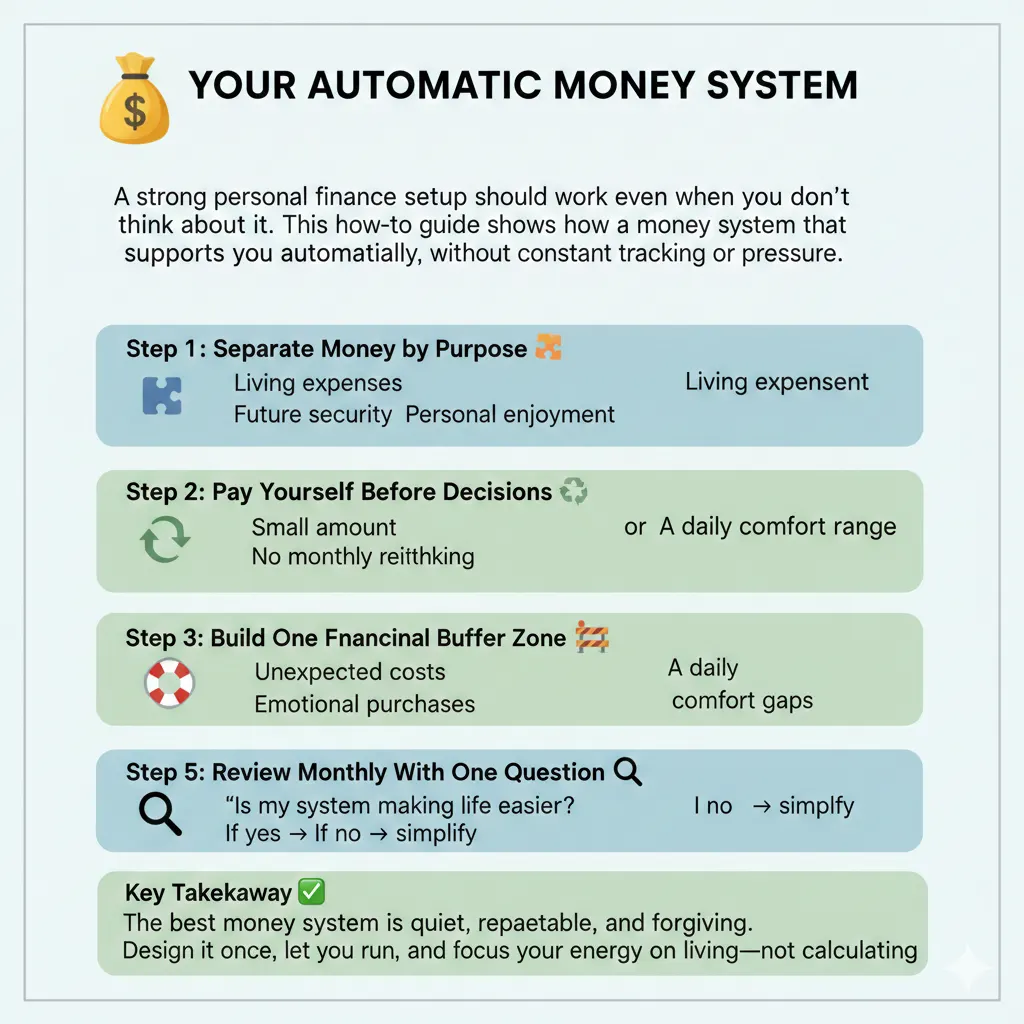

How to Design a Personal Money System That Works Automatically

A practical guide to creating a personal money system that runs quietly in the background, reduces stress, and supports long-term financial balance.

A strong personal finance setup should work even when you don’t think about it. This how-to guide shows how to design a money system that supports you automatically, without constant tracking or pressure. 💰

Step 1: Separate Money by Purpose 🧩

Create clear roles for your money:

-

Living expenses

-

Future security

-

Personal enjoyment

When money has a job, it stops creating mental noise.

Step 2: Pay Yourself Before Decisions 🔁

Move savings automatically as soon as money arrives.

-

Small amount

-

Fixed rule

-

No monthly rethinking

Automation beats motivation every time.

Step 3: Use One Spending Boundary 🚧

Set one simple limit:

-

A weekly spending cap

or -

A daily comfort range

Avoid tracking every transaction—track the boundary instead.

Step 4: Build a Financial Buffer Zone 🛟

Keep a calm reserve for:

-

Unexpected costs

-

Emotional purchases

-

Income gaps

Buffers protect your habits, not just your wallet.

Step 5: Review Monthly With One Question 🔍

Ask:

“Is my system making life easier?”

If yes → keep it

If no → simplify

Key Takeaway ✅

The best money system is quiet, repeatable, and forgiving. Design it once, let it run, and focus your energy on living—not calculating.