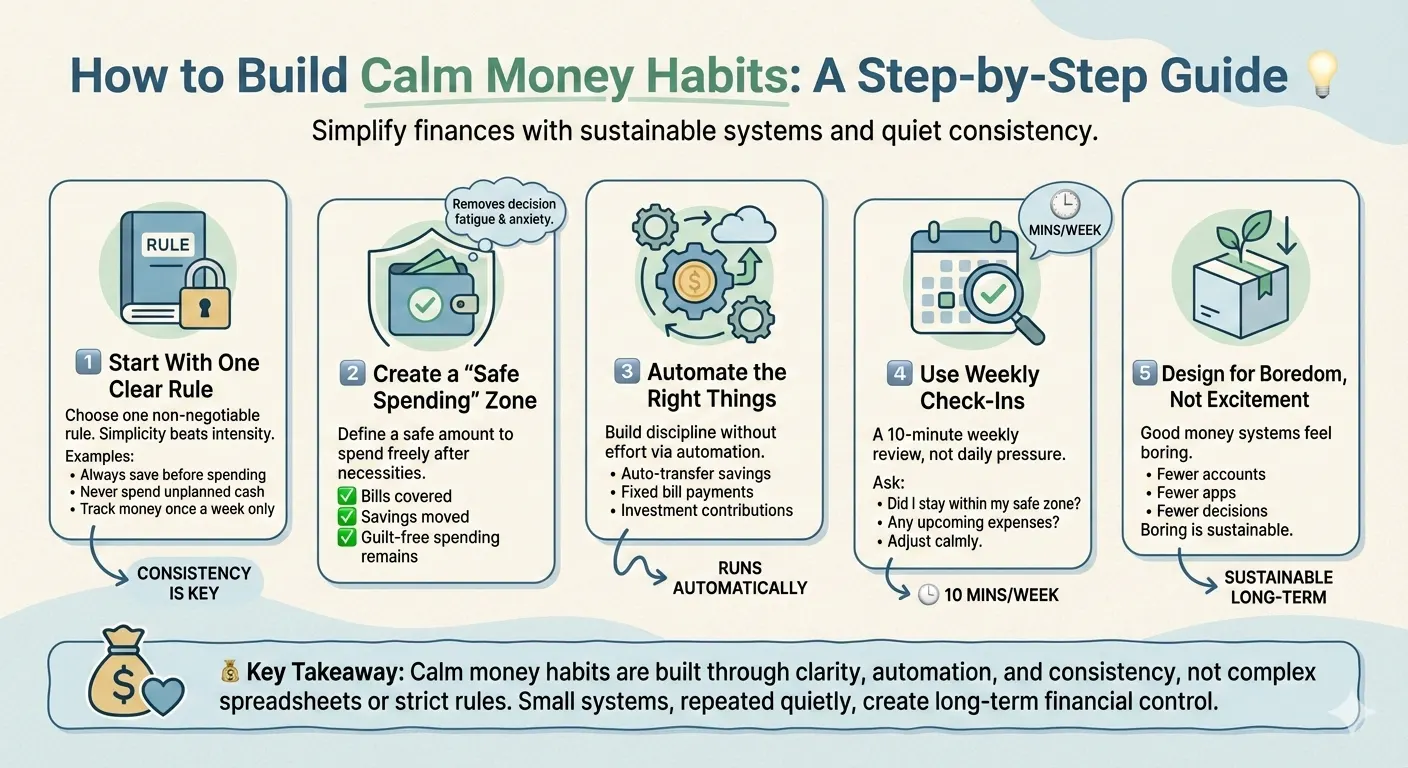

How to Build an Emergency Fund: Essential Steps for Financial Security

Practical steps to create a robust emergency fund that protects against unexpected expenses, ensuring long-term financial stability through smart saving habits.

Building an emergency fund acts as a safety net for life's surprises, like sudden repairs or medical bills. This guide walks you through simple, actionable steps to get started and maintain it.

Step 1: Assess Your Needs 💡 Start by calculating how much you need. Aim for three to six months of living expenses. Add up essentials like rent, food, and utilities to find your target amount.

"An emergency fund isn't just savings—it's your first line of defense against debt."

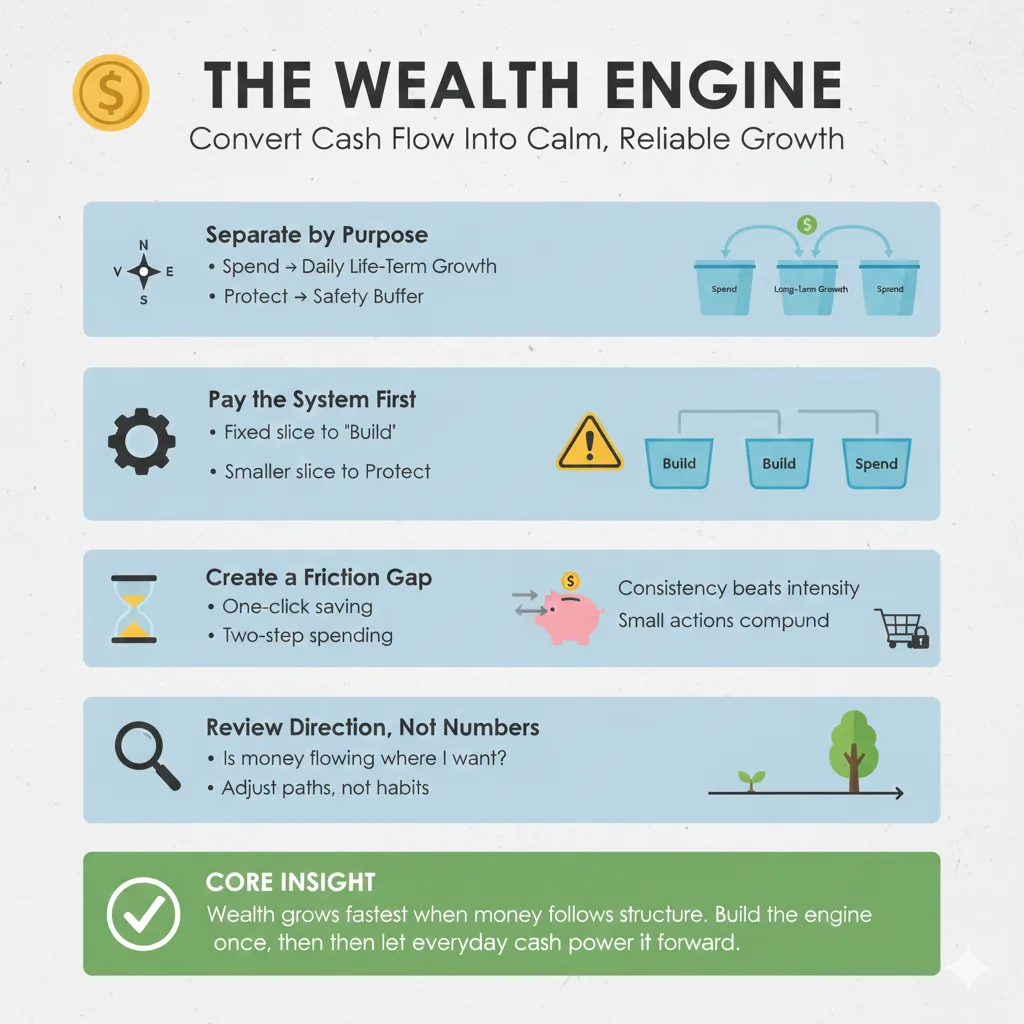

Step 2: Set a Realistic Goal Break it down into small milestones. If your target is high, begin with one month's worth. Use automatic transfers from your paycheck to build it steadily without effort.

Step 3: Choose the Right Account 🔒 Opt for a high-yield savings account to earn interest while keeping funds accessible. Avoid mixing it with everyday checking to prevent temptation.

Step 4: Cut Unnecessary Expenses Review your spending habits. Skip impulse buys and redirect that money. For example, brewing coffee at home can add up quickly to boost your fund.

Step 5: Boost Your Income 🚀 Take on side gigs or sell unused items. Extra earnings go straight to your fund, accelerating growth without straining your main budget.

Step 6: Monitor and Adjust Regularly check progress and tweak as life changes. Replenish after use to keep it strong.

With these steps, you'll gain control over your finances, reducing stress and paving the way for future investments. Start small, stay consistent, and watch your security grow.