How to Create a Budget That Actually Works for Real Life

Stop failing at budgeting forever. This step-by-step guide shows you how to build a flexible, guilt-free budget that fits your real life

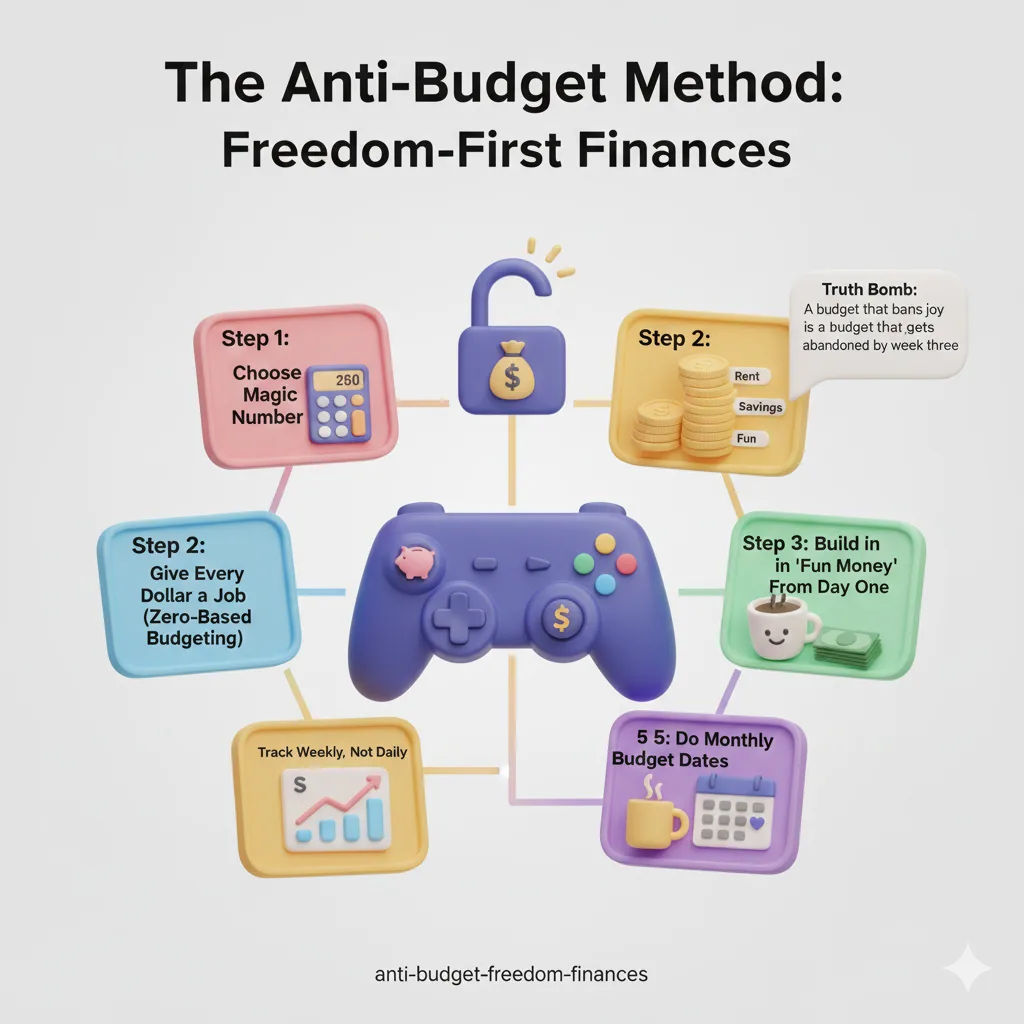

Most budgets fail because they feel like punishment. This method flips that — it gives you freedom while still hitting your money goals.

Step 1: Choose Your Magic Number Add up all income that reliably hits your account each month (after taxes). This is your one number to work with — no guessing, no hoping for bonuses.

💡 Rule: If it’s not predictable, don’t budget it yet.

Step 2: Give Every Dollar a Job (Zero-Based Budgeting) List expenses in this exact order: essentials first (rent, food, bills), savings second, debt payoff third, everything else last. Keep subtracting until you hit zero. 🚀 Game Changer: When dollars have names, overspending becomes impossible.

Step 3: Build in “Fun Money” From Day One Yes, even if you’re broke. Allocate a small guilt-free amount for coffee, hobbies, or takeout. Zero fun = zero chance of sticking to the plan.

🔑 Truth Bomb: A budget that bans joy is a budget that gets abandoned by week three.

Step 4: Track Weekly, Not Daily Check your numbers every Sunday night for 10 minutes. Adjust upcoming categories instead of beating yourself up over yesterday. 📊 Pro Move: Use sinking funds for irregular expenses (car insurance, holidays) so they never wreck your month.

Step 5: Do Monthly Budget Dates Once a month, sit down (with coffee or wine) and plan the next month before it starts. Involve your partner if you have one — it’s cheaper than therapy.

🌟 Final Secret: The most successful budgeters treat it like a video game: beat last month’s score.

Your budget isn’t your boss — it’s your employee. Make it work for you, not against you, and watch your money stress melt away.