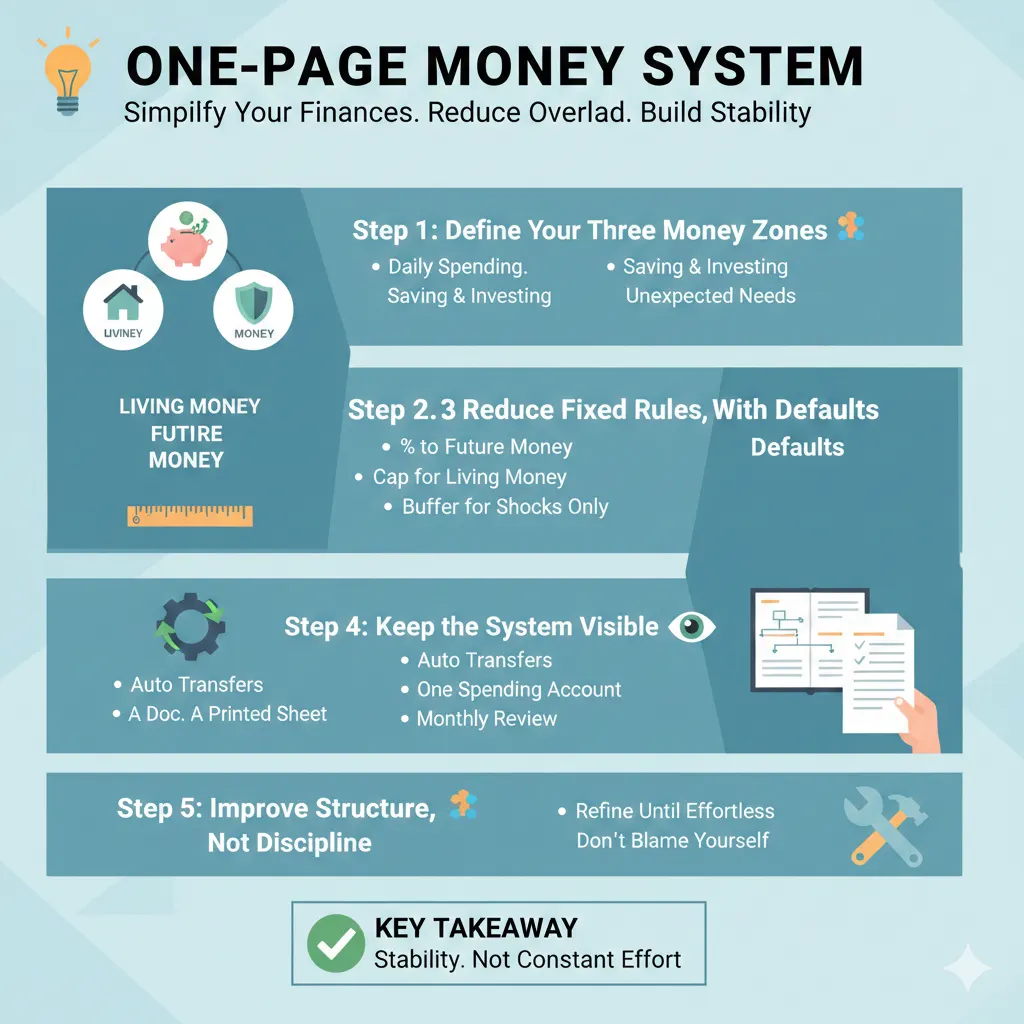

How to Design a One-Page Money System That Runs Itself

A practical step-by-step guide to creating a simple one-page money system that reduces decisions, builds stability, and grows wealth quietly over time.

Managing money becomes easier when everything fits into one clear system. This how-to guide shows how to build a one-page money setup that works daily without mental overload. 💡

Step 1: Define Your Three Money Zones 🧩

Your entire system needs only three zones:

-

Living money (daily spending)

-

Future money (saving and investing)

-

Buffer money (unexpected needs)

If money has a place, it stops causing anxiety.

Step 2: Assign Fixed Rules, Not Feelings 📏

Create simple rules like:

-

A set percentage moves to future money

-

A fixed cap for living money

-

Buffer money is touched only for real shocks

Rules prevent emotional decisions.

Step 3: Reduce Choices With Defaults ⚙️

Defaults keep the system running:

-

Automatic transfers

-

One primary spending account

-

One review moment per month

Less choice equals more consistency.

Step 4: Keep the System Visible 👀

Your one-page view can be:

-

A note

-

A simple document

-

A printed sheet

Visibility builds trust in the system.

Step 5: Improve Structure, Not Discipline 🛠️

When something fails, don’t blame yourself.

Refine the system until it feels effortless.

Key Takeaway ✅

A one-page money system removes friction, saves time, and builds financial stability through structure—not constant effort.