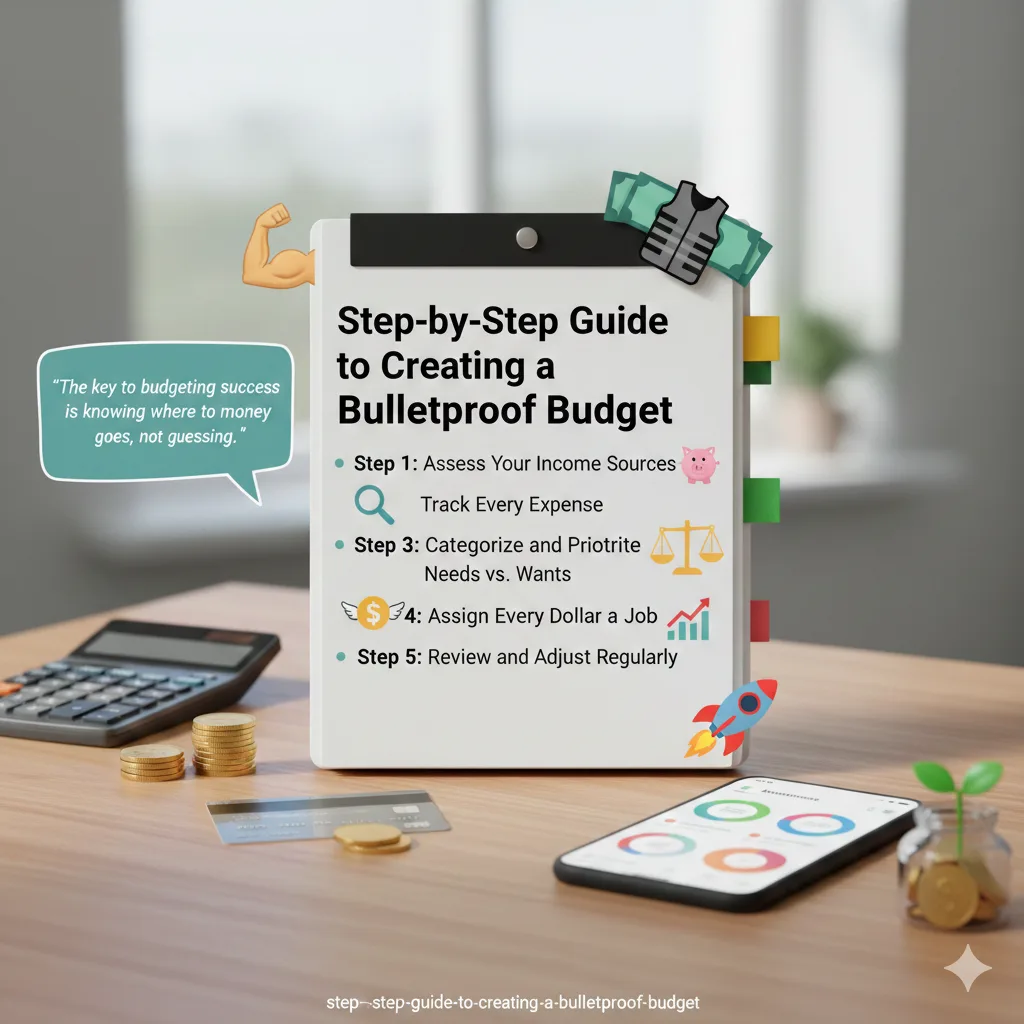

Step-by-Step Guide to Creating a Bulletproof Budget

Unlock financial stability with this easy-to-follow guide on building a bulletproof budget. Learn practical steps to track expenses

Creating a solid budget is the cornerstone of smart money management. This guide walks you through simple, actionable steps to design a plan that fits your lifestyle and boosts your savings. 💪

Step 1: Assess Your Income Sources

Start by listing all your income streams, like salary, freelance gigs, or side hustles. Calculate your total monthly take-home pay after taxes. This gives you a clear foundation.

Step 2: Track Every Expense

For one month, jot down all spending—big and small. Use apps or a notebook to categorize items like groceries, utilities, and entertainment. 🔍 Eye-opening insights await!

"The key to budgeting success is knowing where your money goes, not guessing."

Step 3: Categorize and Prioritize Needs vs. Wants

Divide expenses into essentials (rent, food, bills) and non-essentials (dining out, subscriptions). Prioritize needs first to ensure they're covered. Trim wants to free up cash.

Step 4: Assign Every Dollar a Job

Adopt zero-based budgeting: Allocate your entire income to categories until nothing's left. Include savings and debt payoff as must-haves. This prevents wasteful spending.

Step 5: Review and Adjust Regularly

Check your budget monthly. Adjust for changes like rising costs or new goals. Celebrate wins, like extra savings, to stay motivated. 📈

By following these steps, you'll gain control over your finances and build lasting security. Start small, stay consistent, and watch your wealth grow! 🚀