Smart Path to Financial Control: A Practical How-To Guide

A clear, practical, step-by-step guide that helps you gain control of your money, build confident financial habits, and make smarter choices

How to Take Control of Your Personal Finances: A Simple Step-by-Step Guide

Managing money doesn’t have to feel confusing or stressful. This guide breaks the process into clear, actionable steps you can follow at your own pace. Every step is designed to help you build stability, reduce stress, and create more freedom in your life. 💰✨

1. Define Your Core Financial Goal

Before anything else, choose one clear target.

👉 Examples: build savings, pay off debt, control spending, or start investing.

💡 Tip: Make the goal small and specific so it feels achievable.

2. Track Where Your Money Actually Goes

Spend a week writing down every expense—or use any simple note app.

This creates instant awareness and uncovers your hidden spending patterns.

Bold signs you need this step:

-

You can’t explain where your money disappears

-

Your card “surprises” you with low balances

-

You feel nervous to check your accounts

3. Build a Minimal, Flexible Budget

Think of budgeting as giving your money a purpose, not a punishment.

Break it into three simple buckets:

-

Needs 🏠

-

Wants 🎉

-

Growth (savings + investing) 📈

Keep it flexible. A good budget bends—it doesn't break.

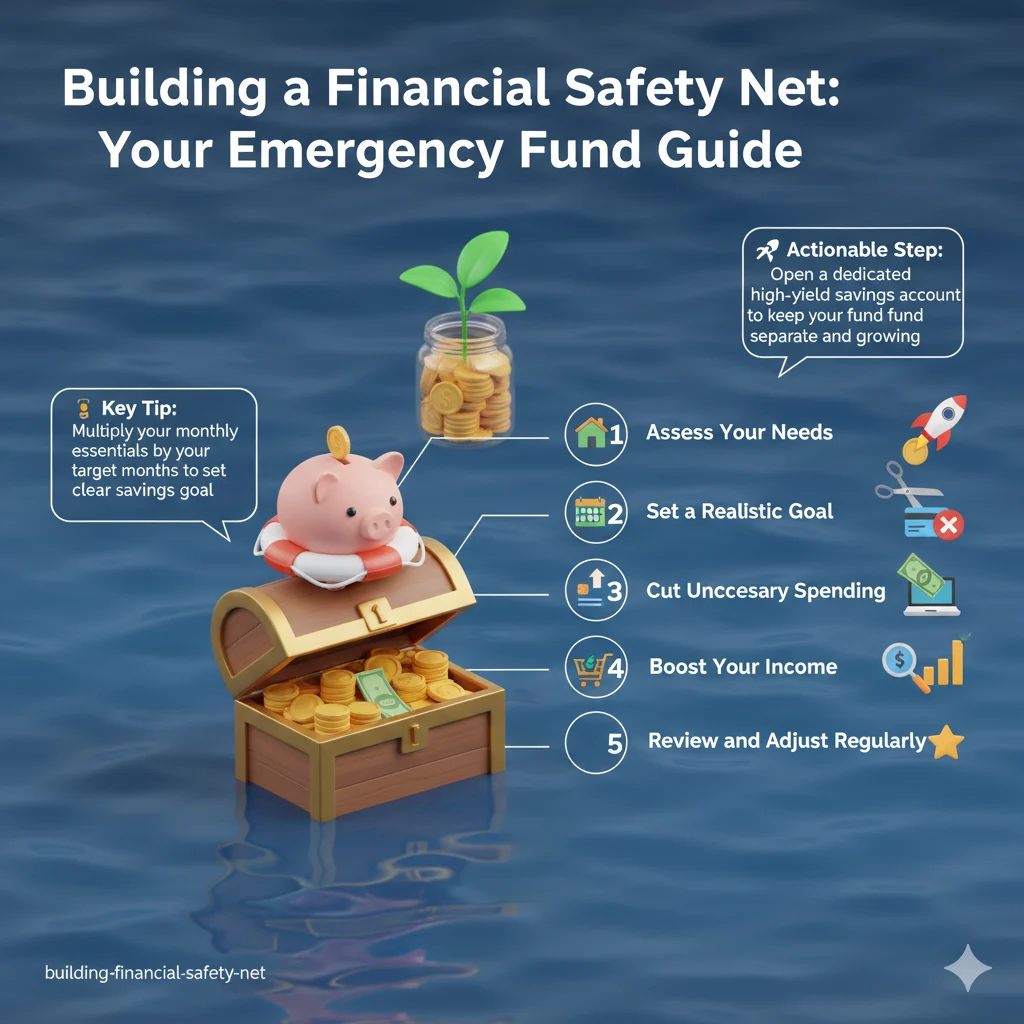

4. Create a Micro Savings System

Small, automated progress beats inconsistent big efforts.

Try these:

-

Auto-transfer a tiny weekly amount

-

Round-up savings

-

A separate “non-touch” account

Even micro steps compound into financial strength.

5. Build a One-Page Debt Strategy

If you have debt, simplify it into one page:

-

List balances

-

Interest rates

-

Minimum payments

-

Your chosen payoff method (snowball or avalanche)

Bold truth: Clarity reduces financial anxiety faster than income growth.

6. Start Investing With Simple Tools

You don’t need to predict markets or understand everything at once.

Begin with broad, low-maintenance options—even tiny amounts count.

Key reminders:

-

Start small

-

Stay consistent

-

Avoid chasing “quick” returns

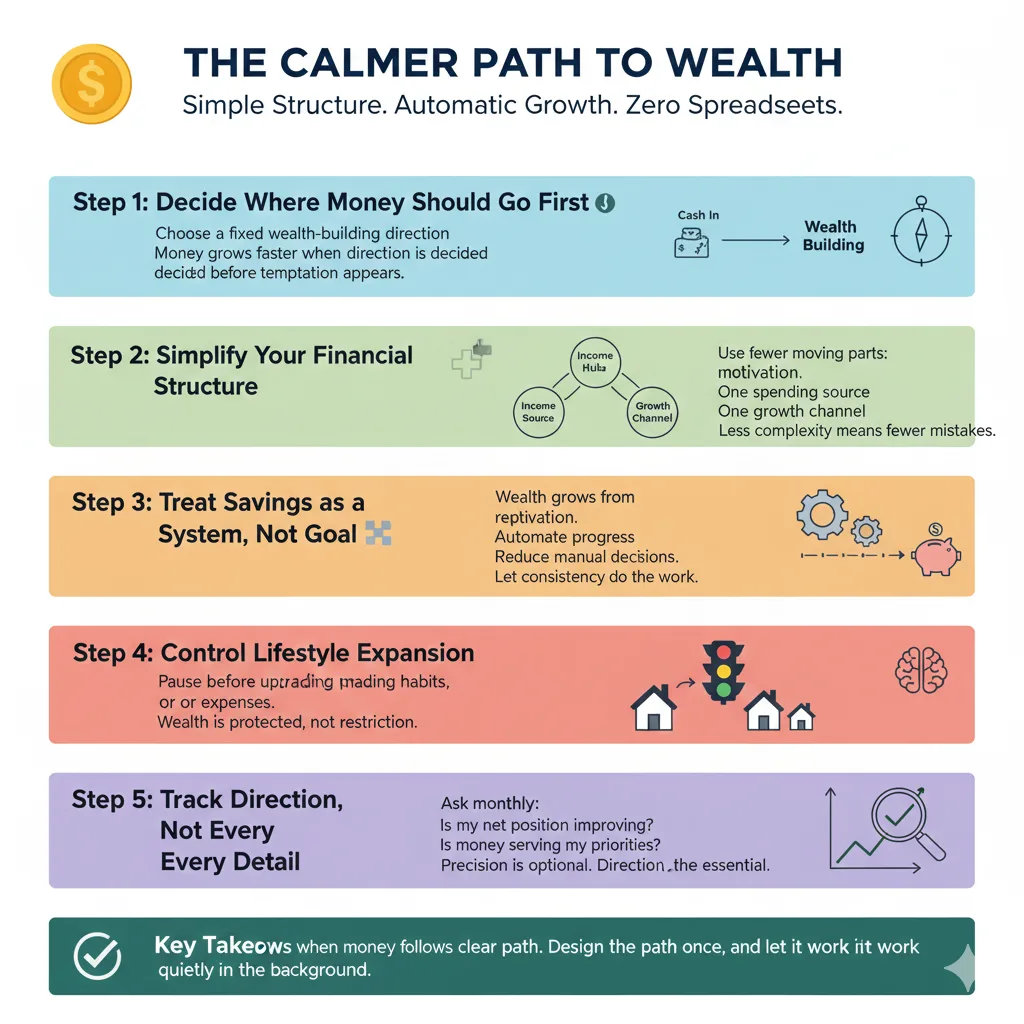

7. Review Weekly, Adjust Monthly

A weekly 5-minute check keeps you aware.

A monthly review helps you adjust without stress.

Ask yourself:

-

What worked?

-

What didn’t?

-

What needs to change?

This habit alone turns chaos into control.

Final Takeaway

Financial control is not a talent—it's a practice.

By following these simple steps, you build a stable, flexible, and confident financial life that supports your goals and gives you long-term peace of mind. 💛