Clear-Mind System for Confident Everyday Decisions

A practical, confidence-building guide that shows readers how to make smart daily money decisions using a simple, repeatable system.

How to Build a Clear-Mind Money System for Confident Financial Decisions

If your finances feel messy, you don’t need complicated formulas—you need a simple system you can trust. This step-by-step guide helps you create a clear-mind method so every money decision feels easier, faster, and smarter.

1️⃣ Create Your “Money Map”

Start by outlining where your money flows.

Include:

-

income sources

-

fixed expenses

-

flexible expenses

-

savings & growth goals

A clear map turns random choices into intentional planning.

You can’t optimize what you can’t see. 🧭

2️⃣ Set a Daily Spending Threshold

Think of this as a personal traffic light.

-

Green: Safe amount you can spend daily without harming goals

-

Yellow: Pause and evaluate

-

Red: Stop—this breaks your long-term plan

This keeps emotions out of everyday decisions.

3️⃣ Use the “Three-Second Rule” for Purchases

Before buying anything, ask:

“Will this matter to me in a week?”

If the answer is “no,” skip it.

If the answer is “yes,” check whether it fits within your threshold.

This tiny habit protects you from impulse spending while keeping life enjoyable.

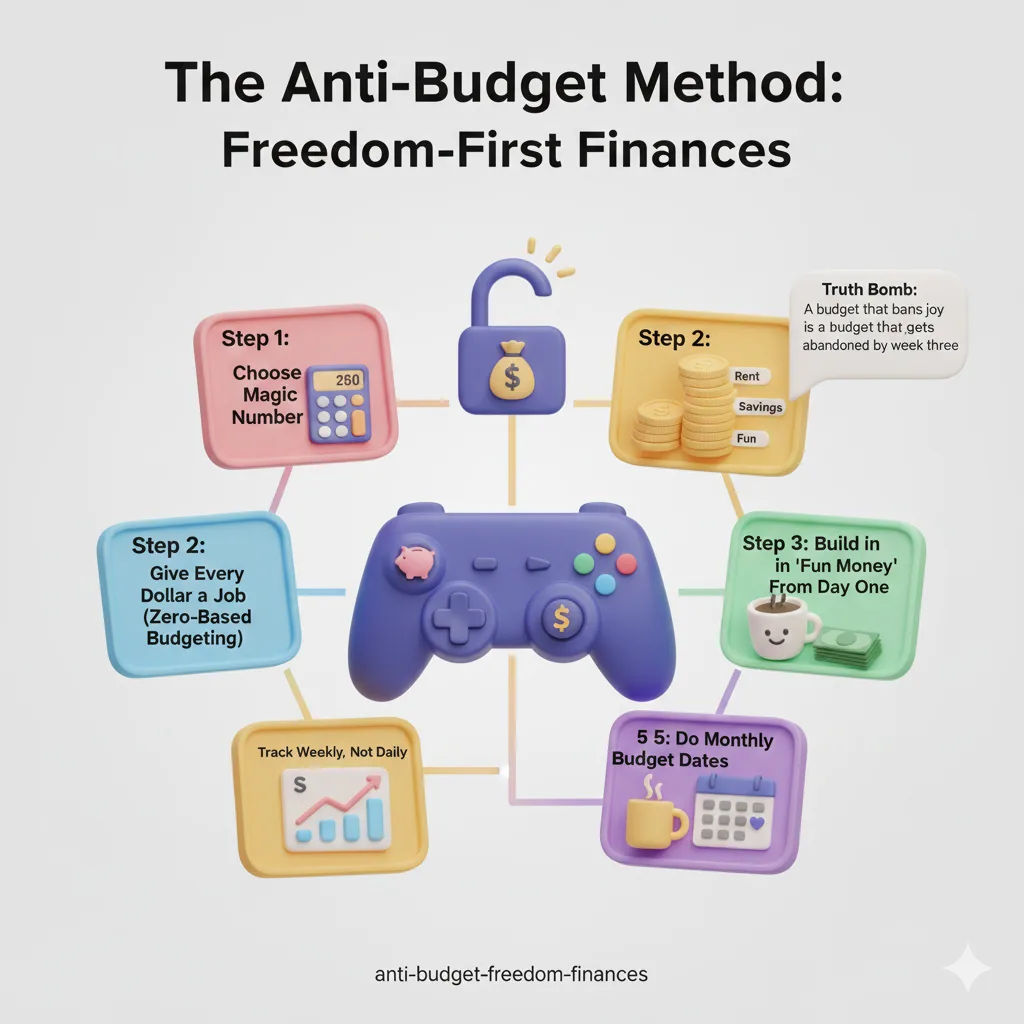

4️⃣ Build a Two-Bucket Savings Strategy

Separate your money into:

⭐ Essential Savings Bucket – future security

⭐ Growth Bucket – wealth building

This simplifies choices and removes the stress of deciding “where” money should go.

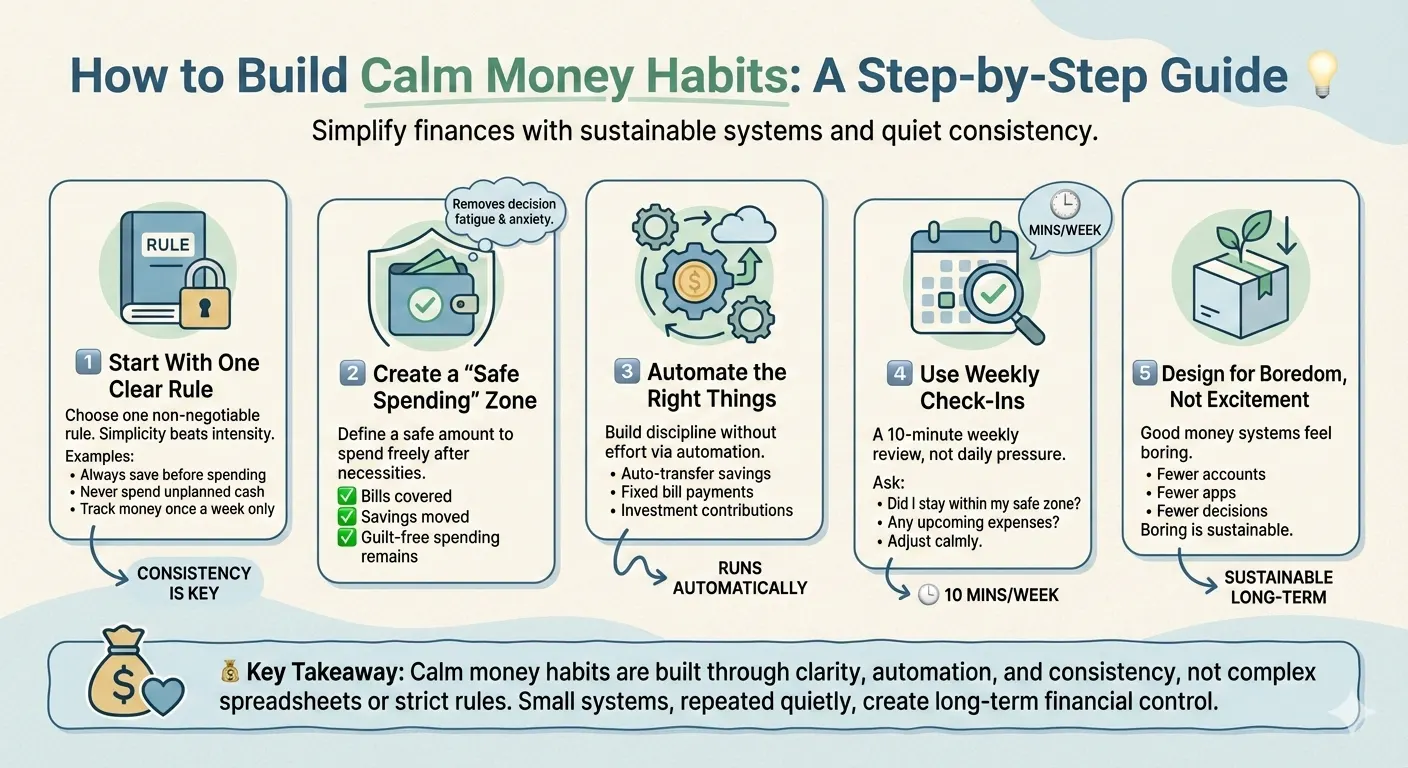

5️⃣ Automate the Important Things

Automation ensures consistency:

-

savings transfers

-

bill payments

-

recurring investments

🧩 Automation is the backbone of a reliable financial system.

6️⃣ Review Weekly Using a 5-Minute Check-In

No long spreadsheets required.

During the check-in, confirm:

-

Did I stay within my threshold?

-

Did any unexpected expenses appear?

-

Is my money aligning with my goals?

Small reviews prevent large problems.

7️⃣ Protect Your System with Micro-Adjustments

Instead of big stressful changes, use small tweaks:

-

reduce one subscription

-

increase savings by a tiny amount

-

adjust thresholds slightly

These micro-moves compound into massive progress.

8️⃣ Keep a “Financial Wins” Note

Write down small victories:

-

avoided a purchase

-

saved extra

-

paid a bill early

🎉 Celebrating progress boosts discipline and motivation.

Final Takeaway

A calm financial life doesn’t come from earning more—it comes from creating a personal system that guides your decisions with clarity and confidence.

Build your clear-mind money system once, refine it, and let it support every smart choice you make.