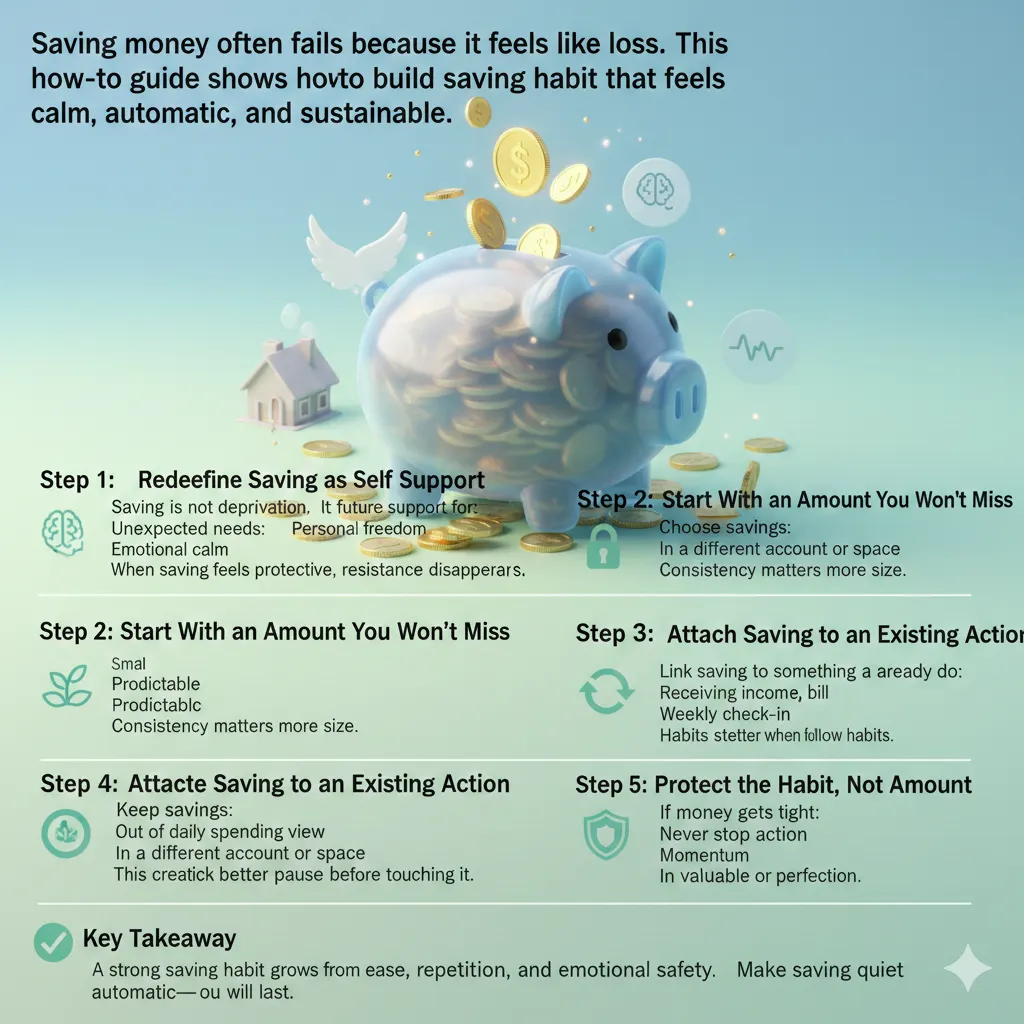

How to Build a Zero Stress Saving Habit From Scratch

A clear and realistic guide to building a saving habit that feels natural, reduces money anxiety, and grows quietly without strict budgeting.

Saving money often fails because it feels like loss. This how-to guide shows how to build a saving habit that feels calm, automatic, and sustainable. 💰

Step 1: Redefine Saving as Self Support 🧠

Saving is not deprivation.

It is future support for:

-

Unexpected needs

-

Personal freedom

-

Emotional calm

When saving feels protective, resistance disappears.

Step 2: Start With an Amount You Won’t Miss 🌱

Choose a number that feels almost insignificant.

-

Small

-

Predictable

-

Automatic

Consistency matters more than size.

Step 3: Separate Saved Money Physically 🔐

Keep savings:

-

Out of daily spending view

-

In a different account or space

This creates a natural pause before touching it.

Step 4: Attach Saving to an Existing Action 🔄

Link saving to something you already do:

-

Receiving income

-

Paying a bill

-

Weekly check-in

Habits stick better when they follow habits.

Step 5: Protect the Habit, Not the Amount 🛡️

If money gets tight:

-

Reduce the amount

-

Never stop the action

Momentum is more valuable than perfection.

Key Takeaway ✅

A strong saving habit grows from ease, repetition, and emotional safety. Make saving quiet and automatic—and it will last.